India's Markets

Simplified For Australia

Access 500+ Mutual Funds from Australia using only your Aus ID.Access 500+ Mutual Funds from Australia using only your Aus ID.

Access 500+ Mutual Funds from AustraliaAccess 500+ Mutual Funds from Australia

using only your Aus ID.using only your Aus ID.

Total Invested

₹14,00,000

TATA

Large Cap Fund

₹7,61,000

Motilal Oswal

Mid Cap Fund

₹7,39,000

REGISTERED NZFSP

FSP1007088

LICENSED

BY SEBI IN INDIA

INTRODUCING INDUS

FoundedFoundedInInANZ,ANZ,IndusIndusExistsExistsToToUnlockUnlockIndia'sIndia'sMarketsMarketsForForAnyoneAnyoneLivingLivingHere.Here.WithWithRegulationRegulationInInBothBothCountries,Countries,WeWeMakeMakeInvestingInvestingInInTheTheWorld'sWorld'sFastestFastestGrowingGrowingEconomyEconomySafe,Safe,Transparent,Transparent,AndAndWithinWithinReach.Reach.

Investing in india from au

Now Easy As

Forget the red tape, with Indus, investing in India is fast, economical, and paperwork-free.

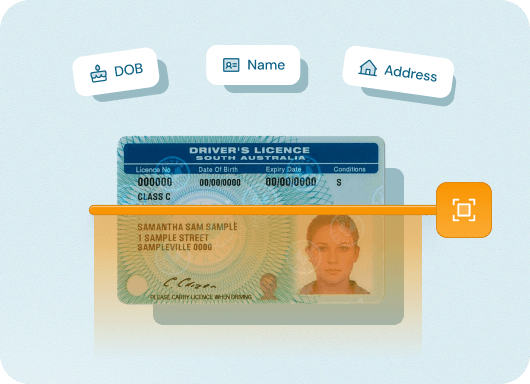

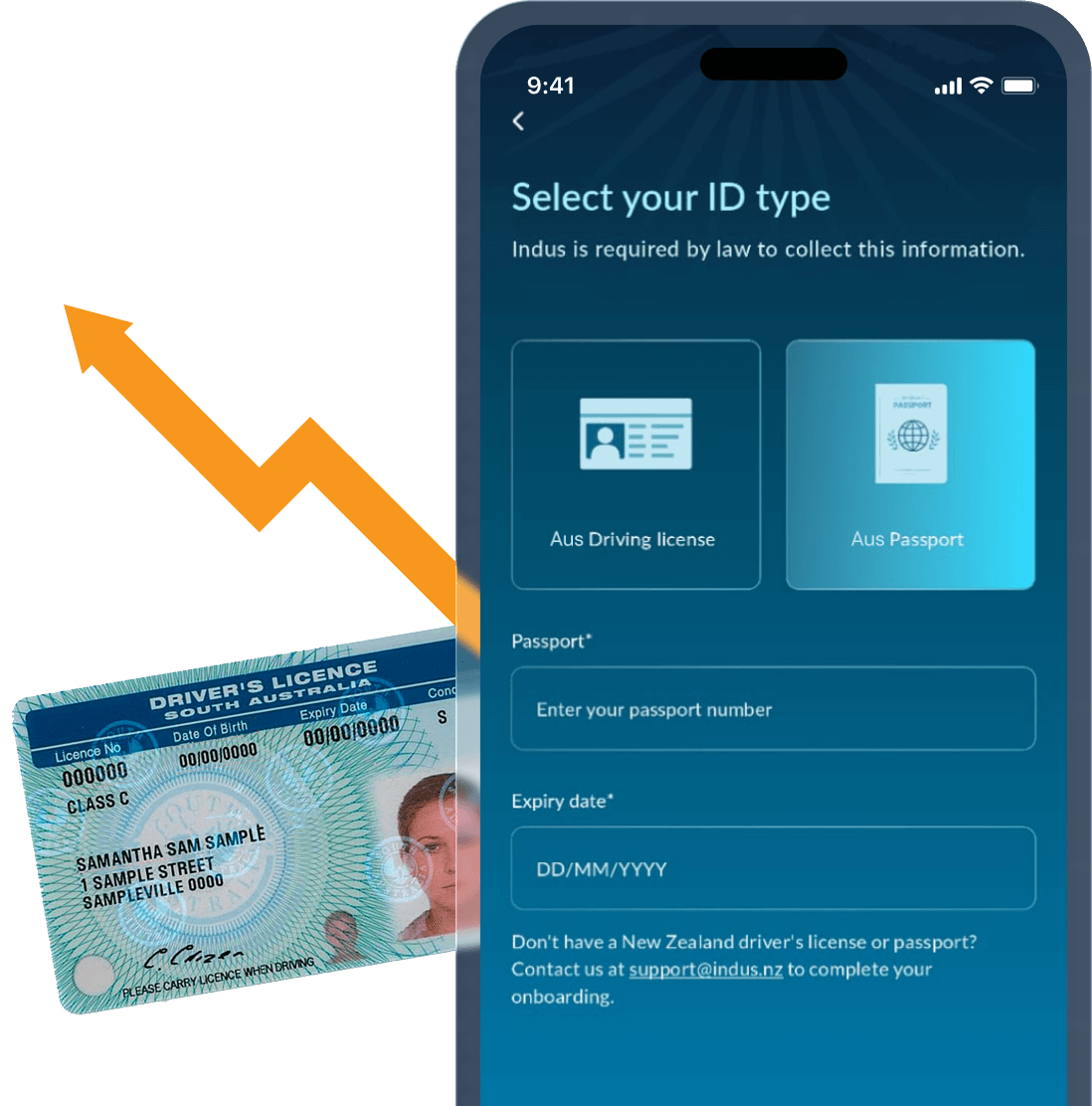

Sign Up In 3 Minutes

Using a AUS Driving License/ Passport, no Indian document needed.

Cost Efficient

Best in class f/x and no transfer fees, pay 0 tax in India.

500+ High Quality

Indian Mutual Funds

Indus is partnered with household names like Motilal Oswal, ICICI, HDFC, Quant and many more!

Indus is a certified Mutual Fund distributor registered with Association of Mutual Funds in India (AMFI) with Reg. No. ARN–OD338069

How It Works

Get Started

IN MINUTES

VERIFY

GET VERIFIED IN 60 SECONDS

All you need is a Aus Drivers License or passport to get verified!

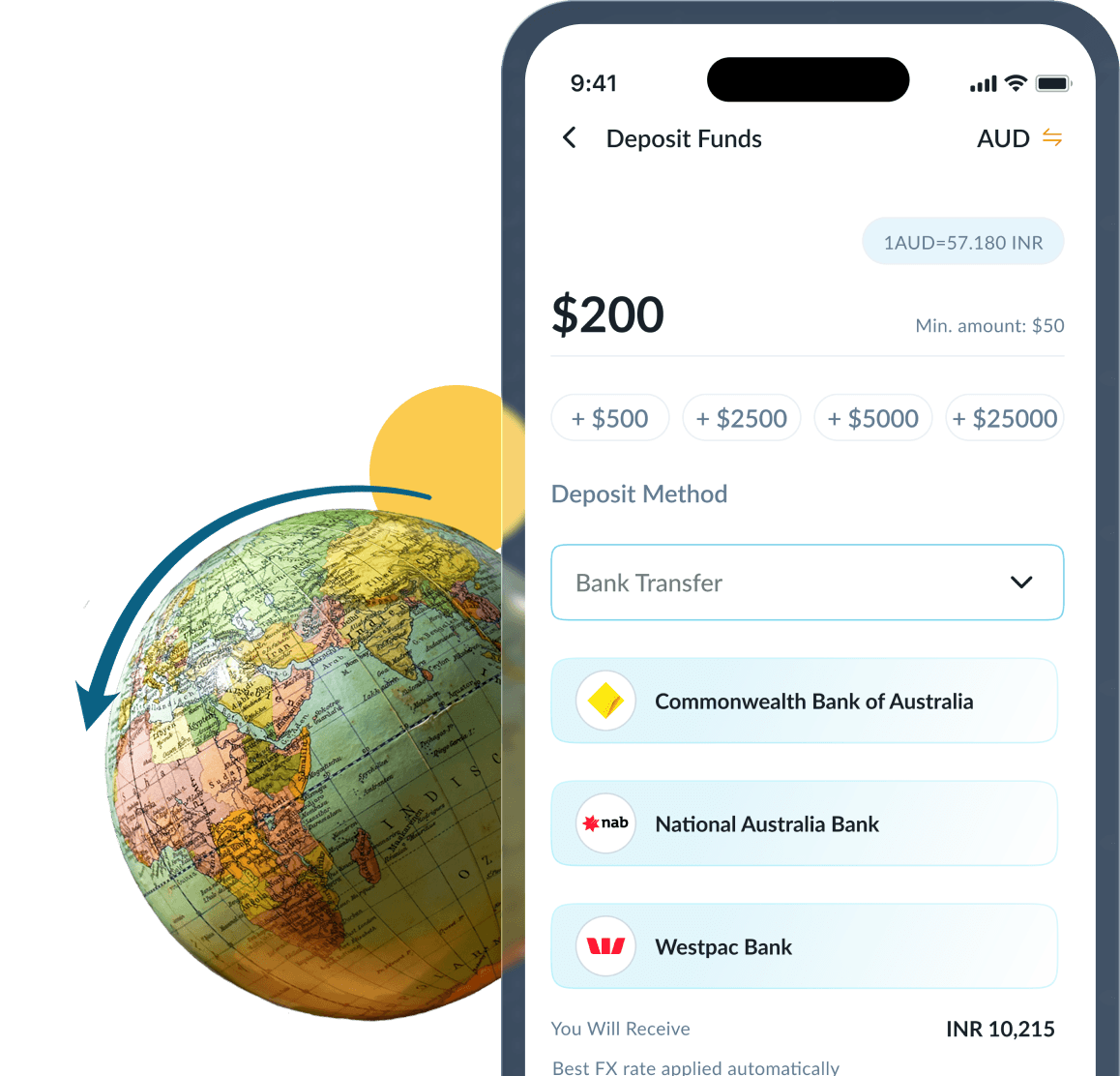

DEPOSIT

FUND YOUR WALLET INSTANTLY

Add funds to your Indus wallet directly from your AU bank account and skip international bank transfer fees.

INVEST

INVEST IN 500+ MUTUAL FUNDS

Start an SIP or a lump sum investment or both!

REPATRIATE

EXIT ANYTIME, STRESS-FREE

Withdraw your gains to AUD directly to your Aus bank account with just a tap. No waiting, no lock-ins.

India’s Growth, Expertly Managed

Why Mutual Funds For Indian Markets

(And Why Through Indus)

(And Why Through Indus)

India's Growth, Expertly Managed

Why Mutual Funds For Indian

Markets (And Why Through Indus)

Markets (And Why Through Indus)

Diversified investment

Across multiple companies and sectors = lower risk, higher consistency

Long-Term Growth

By staying invested through market cycles, your money compounds, turning disciplined investing into financial freedom.

Professional Management

Access to India’s top fund managers who actively research and rebalance portfolios.

Mutual Funds Are Professionally Managed

By India's Smartest Fund Managers

SBI MUTUAL FUND

India's largest mutual fund, backed by SBI & Amundi, with 37+ years of trusted wealth management. #1 by market share (17.6%).

AUM

$238.14 BN

Active Investors

22.1 MN

ICICI PRUDENTIAL AMC

Joint venture of ICICI Bank and Prudential Plc. 27 years of leadership, holding 12.6% market share. Morningstar Award 2025 winner.

AUM

$204.75 BN

Active Investors

11.9 MN+

HDFC AMC

25 years of accessible investing, largest equity AMC Est. 2011, most profitable AMC Est. 2013. Multiple industry awards, including Lipper Best Overall Fund.

AUM

$204.75 BN

Market Share

11%

Nippon India AMC

Backed by Nippon Life (Japan). Largest unique investor base in India, serving 1 in every 3 Active Investors. Winner: Morningstar Best Corporate Bond Fund 2025.

AUM

$130.59 BN

Active Investors

21.2 MN

Kotak AMC

Part of Kotak Group. Over 25 years of disciplined investing with 13 million Active Investors. Recognized for innovation in debt & equity products.

AUM

$110.42 BN

Branches

92+

Aditya Birla Sun Life AMC

Joint venture of Aditya Birla Capital & Sun Life Financial. 31 years of trust, global presence (Mauritius, Dubai, Singapore). Went public in 2021.

AUM

$82.79 BN

Active Investors

10.6 MN+

Axis AMC

Over 20 years of disciplined stock-picking. Winner of Morningstar Awards 2022 for Best Equity, Debt & Overall Fund House.

AUM

$68.61 BN

UTI AMC

India’s first mutual fund house, with 60+ years of unmatched legacy. Strong brand equity, and stellar long-term SIP track records.

AUM

$68.34 BN

Mirae Asset India

Fastest-growing AMC in India with 36% AUM CAGR over 5 years. Flagship Large Cap Fund delivered 14.7% CAGR over 15 years.

AUM

$42.47 BN

Active Investors

7.3 MN+

Tata Mutual Fund

30 years of trust, backed by Tata Group’s 100-year legacy. Fastest-growing AMC in FY24 with 50% AUM growth. Known for pioneering investor education.

AUM

$41.45 BN

Active Investors

6.17 MN+

SBI MUTUAL FUND

India's largest mutual fund, backed by SBI & Amundi, with 37+ years of trusted wealth management. #1 by market share (17.6%).

AUM

$238.14 BN

Active Investors

22.1 MN

ICICI PRUDENTIAL AMC

Joint venture of ICICI Bank and Prudential Plc. 27 years of leadership, holding 12.6% market share. Morningstar Award 2025 winner.

AUM

$204.75 BN

Active Investors

11.9 MN+

HDFC AMC

25 years of accessible investing, largest equity AMC Est. 2011, most profitable AMC Est. 2013. Multiple industry awards, including Lipper Best Overall Fund.

AUM

$204.75 BN

Market Share

11%

Nippon India AMC

Backed by Nippon Life (Japan). Largest unique investor base in India, serving 1 in every 3 Active Investors. Winner: Morningstar Best Corporate Bond Fund 2025.

AUM

$130.59 BN

Active Investors

21.2 MN

Kotak AMC

Part of Kotak Group. Over 25 years of disciplined investing with 13 million Active Investors. Recognized for innovation in debt & equity products.

AUM

$110.42 BN

Branches

92+

Aditya Birla Sun Life AMC

Joint venture of Aditya Birla Capital & Sun Life Financial. 31 years of trust, global presence (Mauritius, Dubai, Singapore). Went public in 2021.

AUM

$82.79 BN

Active Investors

10.6 MN+

Axis AMC

Over 20 years of disciplined stock-picking. Winner of Morningstar Awards 2022 for Best Equity, Debt & Overall Fund House.

AUM

$68.61 BN

UTI AMC

India’s first mutual fund house, with 60+ years of unmatched legacy. Strong brand equity, and stellar long-term SIP track records.

AUM

$68.34 BN

Mirae Asset India

Fastest-growing AMC in India with 36% AUM CAGR over 5 years. Flagship Large Cap Fund delivered 14.7% CAGR over 15 years.

AUM

$42.47 BN

Active Investors

7.3 MN+

Tata Mutual Fund

30 years of trust, backed by Tata Group’s 100-year legacy. Fastest-growing AMC in FY24 with 50% AUM growth. Known for pioneering investor education.

AUM

$41.45 BN

Active Investors

6.17 MN+

SBI MUTUAL FUND

India's largest mutual fund, backed by SBI & Amundi, with 37+ years of trusted wealth management. #1 by market share (17.6%).

AUM

$238.14 BN

Active Investors

22.1 MN

ICICI PRUDENTIAL AMC

Joint venture of ICICI Bank and Prudential Plc. 27 years of leadership, holding 12.6% market share. Morningstar Award 2025 winner.

AUM

$204.75 BN

Active Investors

11.9 MN+

HDFC AMC

25 years of accessible investing, largest equity AMC Est. 2011, most profitable AMC Est. 2013. Multiple industry awards, including Lipper Best Overall Fund.

AUM

$204.75 BN

Market Share

11%

Nippon India AMC

Backed by Nippon Life (Japan). Largest unique investor base in India, serving 1 in every 3 Active Investors. Winner: Morningstar Best Corporate Bond Fund 2025.

AUM

$130.59 BN

Active Investors

21.2 MN

Kotak AMC

Part of Kotak Group. Over 25 years of disciplined investing with 13 million Active Investors. Recognized for innovation in debt & equity products.

AUM

$110.42 BN

Branches

92+

Aditya Birla Sun Life AMC

Joint venture of Aditya Birla Capital & Sun Life Financial. 31 years of trust, global presence (Mauritius, Dubai, Singapore). Went public in 2021.

AUM

$82.79 BN

Active Investors

10.6 MN+

Axis AMC

Over 20 years of disciplined stock-picking. Winner of Morningstar Awards 2022 for Best Equity, Debt & Overall Fund House.

AUM

$68.61 BN

UTI AMC

India’s first mutual fund house, with 60+ years of unmatched legacy. Strong brand equity, and stellar long-term SIP track records.

AUM

$68.34 BN

Mirae Asset India

Fastest-growing AMC in India with 36% AUM CAGR over 5 years. Flagship Large Cap Fund delivered 14.7% CAGR over 15 years.

AUM

$42.47 BN

Active Investors

7.3 MN+

Tata Mutual Fund

30 years of trust, backed by Tata Group’s 100-year legacy. Fastest-growing AMC in FY24 with 50% AUM growth. Known for pioneering investor education.

AUM

$41.45 BN

Active Investors

6.17 MN+

USER STORIES

What It Means To Invest

With Confidence

With Confidence

EFFORTLESS!

"Exposure to the India growth story is a critical part of my overall investment mix. Indus made it effortless for me."

EASY AS PIE!

"I had been searching for years to invest in Indian mutual funds without complicated steps. Indus made it easy as pie."

ONE-STOP-SHOP SOLUTION

"With easy sign up, variety of mutual funds available and the instantaneous deposit and withdrawals, Indus is a one-stop-shop solution for investing in India."

MONEY GROWING IN INDIA

"Being an Indian, to have money accessible and growing in India is the best thing that can happen to us."

LOW FX FEE

"Indus offers a very clear and transparent platform, which is better than any other platform or bank."

Umesh Pradhan

Auckland

Booster innovation fund

MELISSA YIANOUTSOS, MANAGER, BOOSTER INNOVATION FUND

We're excited to back Indus at this early stage. Their vision to simplify and open up access to Indian markets for global investors; they are exactly the kind of company we look to support through the Booster Innovation Fund.

New Zealand fintech fund

MARTY KERR, GENERAL PARTNER, NZFF

Indus is exactly the kind of globally ambitious, technically sharp fintech we back. They're setting the standard for cross-border investing.

Sameer Handa MNZM

CHAIRMAN OF BANK OF INDIA (NZ)

I've always believed that New Zealand and India share immense potential for mutual growth. Indus embodies that connection – making investment in India transparent, trustworthy, and rooted in Innovation.

Bharat Chawla

FORMER CHAIRMAN INZBC & PARTNER AHIA INVESTMENT

Education and cross-border opportunities have always driven my work. Indus empowers investors in New Zealand to participate confidently in India's growth – creating real economic and cultural bridges between our countries.

INVESTING IN INDIA

Frequently Asked

Questions

REACH OUT

support@indus.nz

0800 463 871

Your money is always safe with Indus. All client funds are held in a dedicated Australian trust account with a top bank, and investments in India are securely custodied with DBS Bank. By law, your money can only be used to invest in Indian mutual funds and securities, nothing else. We use the same level of encryption and data security as major banks and comply with strict financial regulations in both Australia/New Zealand and India. Indus is licensed by SEBI in India and registered as a Financial Services Provider in ANZ, ensuring your investments are fully protected at every step.

At Indus, we keep our fees simple, transparent, and highly competitive. There are no transaction fees when buying or selling mutual funds through the platform, so your full investment goes toward building your portfolio. We only charge a 1% exchange fee when converting between AUD/NZD and INR, while still offering some of the most competitive rates in the market.

In the highly unlikely event that Indus were to shut down, your investments and funds would remain completely secure. All investments made through Indus are held in trust and custodied by DBS Bank India, under full regulatory oversight. Your assets are never mixed with Indus’s operations and remain fully in your name. In such a situation, arrangements would be made to facilitate the direct return of your assets. Your investments are protected by structure and regulation, not by promises.

No, SIPs on Indus are completely flexible. You can start, pause, or cancel anytime. They’re liquid, with no charges for skipping or stopping. You’re always in control of your investment journey — no lock-ins, no penalties, and no hidden terms.

Cash you add to your wallet is held in a regulated Australian trust account with a leading bank, ring-fenced and completely separate from Indus’s operations. Your investment units are safekept by DBS Bank India under Indus’s SEBI-regulated Foreign Portfolio Investor (FPI) custody. You’re recorded as the beneficial owner in both Indus’s and the custodian’s ledgers. This structure ensures your assets remain yours, fully secure and retrievable even in rare scenarios where Indus ceases operations.

INVESTING IN INDIA

Frequently Asked

Questions

Your money is always safe with Indus. All client funds are held in a dedicated Australian trust account with a top bank, and investments in India are securely custodied with DBS Bank. By law, your money can only be used to invest in Indian mutual funds and securities, nothing else. We use the same level of encryption and data security as major banks and comply with strict financial regulations in both Australia/New Zealand and India. Indus is licensed by SEBI in India and registered as a Financial Services Provider in ANZ, ensuring your investments are fully protected at every step.

At Indus, we keep our fees simple, transparent, and highly competitive. There are no transaction fees when buying or selling mutual funds through the platform, so your full investment goes toward building your portfolio. We only charge a 1% exchange fee when converting between AUD/NZD and INR, while still offering some of the most competitive rates in the market.

In the highly unlikely event that Indus were to shut down, your investments and funds would remain completely secure. All investments made through Indus are held in trust and custodied by DBS Bank India, under full regulatory oversight. Your assets are never mixed with Indus’s operations and remain fully in your name. In such a situation, arrangements would be made to facilitate the direct return of your assets. Your investments are protected by structure and regulation, not by promises.

No, SIPs on Indus are completely flexible. You can start, pause, or cancel anytime. They’re liquid, with no charges for skipping or stopping. You’re always in control of your investment journey — no lock-ins, no penalties, and no hidden terms.

Cash you add to your wallet is held in a regulated Australian trust account with a leading bank, ring-fenced and completely separate from Indus’s operations. Your investment units are safekept by DBS Bank India under Indus’s SEBI-regulated Foreign Portfolio Investor (FPI) custody. You’re recorded as the beneficial owner in both Indus’s and the custodian’s ledgers. This structure ensures your assets remain yours, fully secure and retrievable even in rare scenarios where Indus ceases operations.